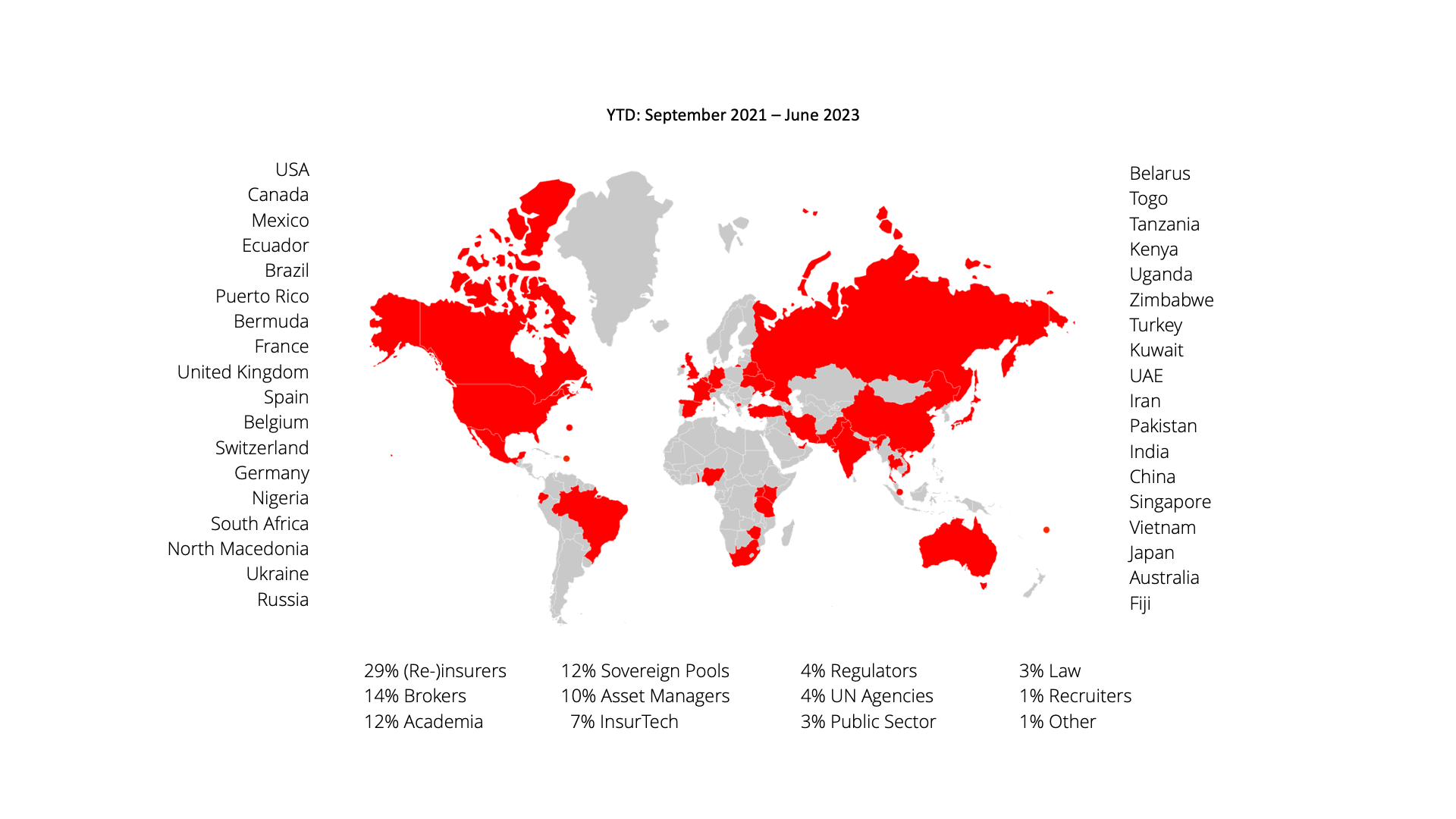

For professionals across sectors, the course offers a roadmap to navigate the often complex landscape of investment management. Whether it’s understanding the role of a wealth manager, the intricacies of mutual funds, or the operational dynamics of broker-dealers, participants are equipped with practical case studies to understand the investment journey.

The course provides a deep dive into the workings of capital markets, pivotal for insurance professionals keen on alternative risk transfer. It includes instruments such as catastrophe bonds, which offer a way to leverage the capital markets for insurable risks. The case study on tracking investments from lottery winners to catastrophe bonds, for instance, demystifies the investment process and the role of intermediaries, offering a clear view of how capital flows within the sector.

For public officials working on projects that harness capital markets to achieve development goals, this course presents a helpful guide. The sessions have intricately connected the foundational aspects of capital markets to practical applications, enabling participants to recognise how investments can be mobilised for public good. With the rise in infrastructure financing and green bonds, understanding the depth and breadth of these markets can support projects aimed at societal development or disaster management.

International development organisation professionals, particularly those with limited exposure to the private sector, can greatly benefit from the course’s clear breakdown of financial market operations. From understanding basic investment principles and the structure of various market instruments to the nuances of investment behaviours and strategies, attendees are well-equipped to interact with private sector counterparts and make informed decisions in collaborative projects.